Fidelity Global Macro Analyst Predicts S&P 500 Recovery After Pricing in ‘Enough Pain’ – But There’s a Big Catch

Constancy Investments’ world macro director Jurrien Timmer believes the S&P 500 is now ready to witness a market restoration after dropping about 20% from its all-time excessive this yr.

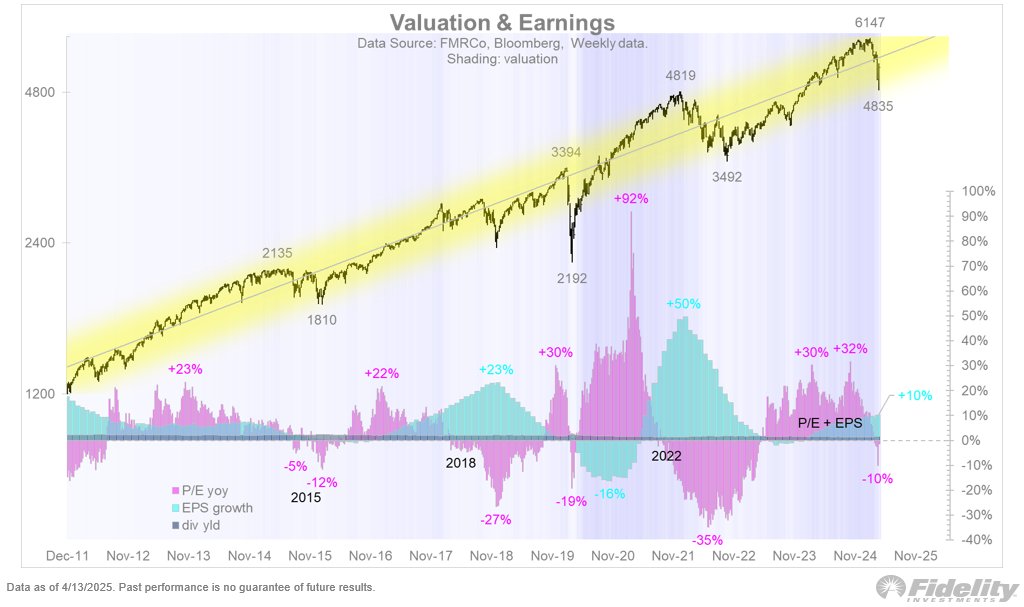

In a brand new thread on the social media platform X, Timmer says that the S&P 500 has been swinging above and beneath a rising trendline way back to December of 2011.

In keeping with the analyst, the newest correction has pushed the inventory market effectively beneath the rising trendline, and it’s now at a degree the place it might stage a comeback.

“Ought to the S&P 500 index overtake that breakdown level, it will occur after the index has totally swung from one excessive to a different.

The chart beneath reveals the index with its rising trendline (exponential regression). Like a pendulum, the market is at all times transferring from one finish to the following, and on this case, it went from effectively above the road to effectively beneath. That means that buyers have priced in sufficient ache to make it price taking the opposite aspect.”

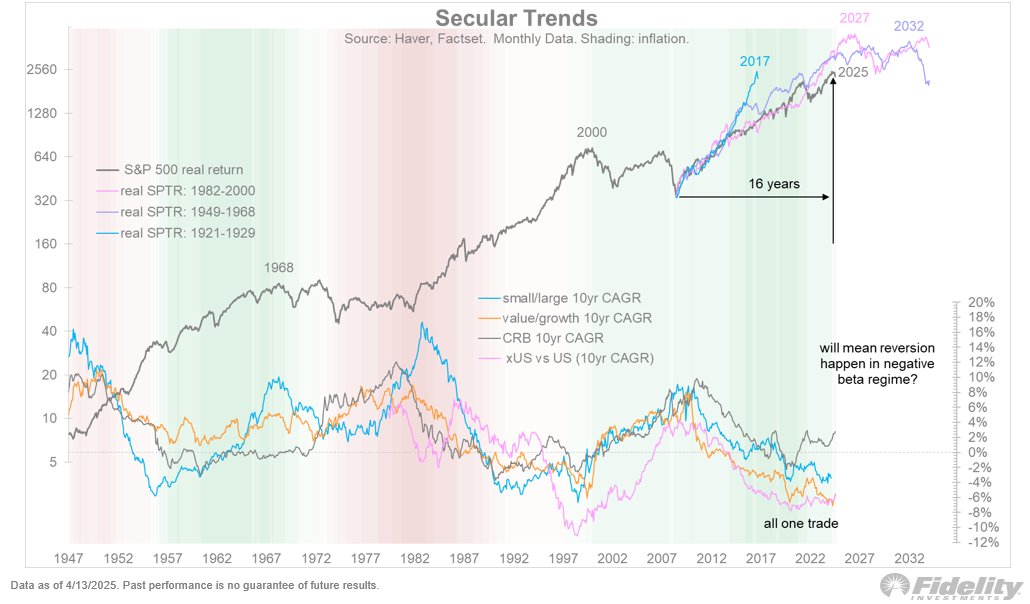

Whereas Timmer believes that equities are primed for an upswing, he warns that the S&P 500’s long-term uptrend – one which began in 2009 – could also be coming into the house stretch. In keeping with Timmer, buyers are more likely to reassess their positions within the US inventory market amid a altering world order.

Timmer believes that buyers will now have a look at essentially sound and undervalued shares, even when these names are exterior of the US markets.

“There is no such thing as a getting round questioning the bullish secular regime wherein now we have been for the reason that monetary disaster resulted in 2009. The timing of the cyclical drawdown raises questions concerning the state of the secular bull, which in my opinion is in its last years. If a brand new world order of de-globalization and de-dollarization is afoot, it might change the panorama for years to return, and that might very effectively usher in a brand new secular regime.

That is an existential query not solely by way of the form of returns we will anticipate within the coming years, but additionally the management throughout the markets. With the Magazine 7 dominance now greater than 10 years previous and fraying, a rotation to worth and worldwide is more likely to occur in a diminished secular beta regime.”

As of Friday’s shut, the S&P 500 is buying and selling at 5,282 factors.

Observe us on X, Facebook and Telegram

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Examine Worth Motion

Surf The Every day Hodl Combine

Generated Picture: Midjourney