What of Bitcoin’s fortunes after GBTC outflows drop for 1st time?

- Every day outflows dropped from $640 million to $255 million.

- Bitcoin recovered considerably over the weekend.

Bitcoin’s [BTC] disappointing run for the reason that approval of spot ETFs has spoiled the occasion for a lot of market members who have been anticipating an on the spot spike in costs.

The king coin was exchanging palms at $42,176, down 13% from the height on the ETF approval day, in accordance with CoinMarketCap.

Grayscale menace looms massive

As has been extensively reported, outflows from the Grayscale Bitcoin Belief (GBTC), which has been transitioned to a spot ETF, have been the first bearish catalyst.

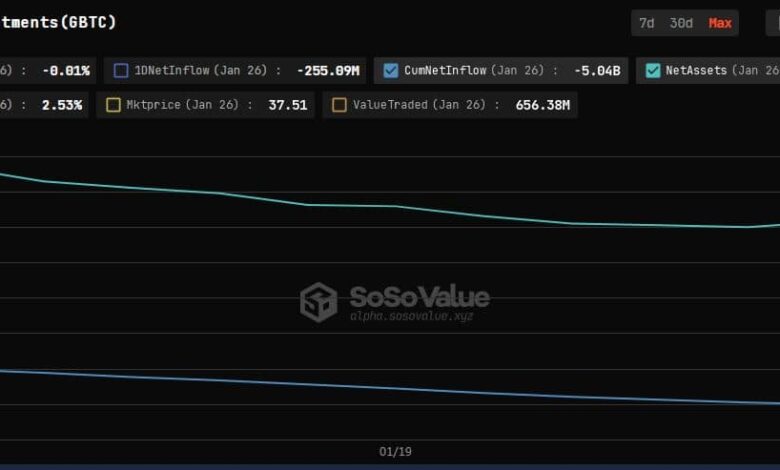

Based on AMBCrypto’s evaluation of SoSoValue knowledge, Bitcoins price over $5 billion have exited the belief for the reason that transition.

GBTC shareholders, who have been beforehand barred from accessing their holdings, began profiting as soon as redemptions have been allowed post-conversion to an ETF.

Supply: SoSo Worth

Contemplating Grayscale nonetheless held greater than 500,000 Bitcoins in its custody at press time, there have been issues about extended bearish situations.

Has the ache began to ease?

Nonetheless, over the previous few days, the speed of outflows has slowed down significantly.

As analyzed by AMBCrypto, the each day outflows progressively dropped from $640 million initially of final week to $255 million by the weekend.

Head of Analysis at Coinshares, James Butterfill, additionally alluded to this gradual discount in a publish on social platform X (previously Twitter).

The outflows in Grayscale aren’t fairly however it seems like they’re starting to subside. pic.twitter.com/IZXHZWbiKG

— James Butterfill (@jbutterfill) January 28, 2024

Furthermore, all of the recently-launched Bitcoin spot ETFs recorded internet inflows on the twenty sixth of January, after 4 straight days of internet outflows.

The truth that Bitcoin jumped above $42,000 on the identical day gave first indications that promoting strain may begin to ebb.

Supply: SoSo Worth

Whales, analysts hopeful

In the meantime, ignoring the short-term blip, influential whale traders continued to build up Bitcoin in massive portions.

Based on AMBCrypto’s evaluation of Glassnode knowledge, the variety of entities holding at the very least 1K cash shot as much as the best stage since Might 2022.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

The trajectory has trended upwards for the reason that spot ETFs received authorized.

Supply: Glassnode

Market observers additionally turned optimistic about Bitcoin’s subsequent actions. Shivam Thakral, CEO of Indian cryptocurrency change BuyUcoin, stated,

“Blackrock Bitcoin ETFs grew to become the primary to the touch $2 billion in AUM and created a wave of optimistic sentiment around the globe’s largest digital asset. We are able to count on Bitcoin to the touch the $45,000 stage if the present momentum sustains and there aren’t any shocking information headlines.”