Ethereum ETF race gets interesting as Valkyrie enters the mix

- Valkyrie utilized for a mixed ETH and BTC ETF.

- ETH worth fell, community development and velocity of the altcoin continued to say no.

Just lately, massive establishments corresponding to Blackrock have drawn a whole lot of consideration to themselves resulting from their purposes for BTC ETFs. These purposes have stirred up curiosity within the king coin and added to the hype across the cryptocurrency. Nonetheless, not too long ago the businesses that have been making use of for Bitcoin ETF, additionally began to use for Ethereum[ETH]-based ETFs.

Real looking or not, right here’s ETH’s market cap in BTC’s phrases

Valkyrie for assist

During the last week, Valkyrie submitted a 497-form outlining their intention to remodel their Bitcoin ETF into an ETF combining Bitcoin and Ether, with a projected launch date of three October. This timeline would put their debut two weeks forward of the scheduled launch of the opposite 13 candidates.

In response to Eric Balchunas, an ETF analyst at Bloomberg, there have been 14 Ethereum-based ETFs filed at press time.

And.. this is #14. Effectively, kinda.. Valkyrie seeking to convert $BTF right into a Bitcoin + Ether Futures ETF pic.twitter.com/XuBxUkk7G4

— Eric Balchunas (@EricBalchunas) August 4, 2023

The substantial inflow of candidates looking for to ascertain Ethereum ETFs might doubtlessly bolster a extra favorable sentiment towards Ethereum. Nonetheless, the previous month has seen a decline in ETH’s worth, with a drop to $1834.5.

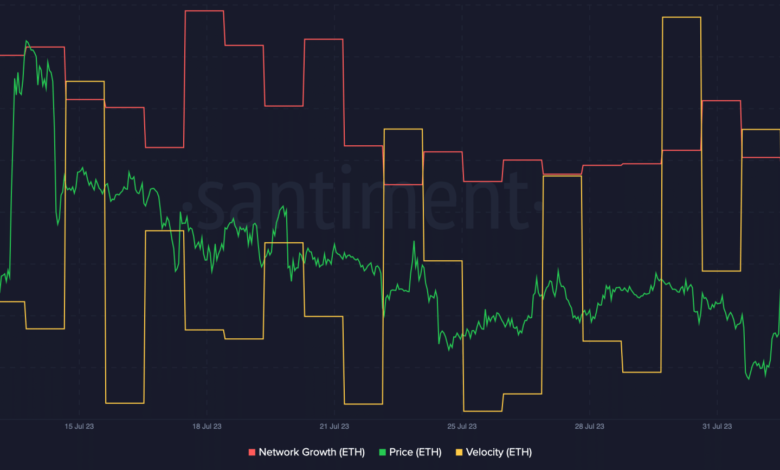

Concurrently, community development additionally faltered, which indicated a diminishing curiosity in new addresses partaking with ETH. This development was additional accentuated by the plummeting velocity of ETH, indicative of diminished alternate exercise amongst addresses during the last month.

Supply: Santiment

No indicators of inexperienced

Because of the decline within the worth of ETH, the MVRV ratio for the cryptocurrency fell materially. This confirmed that almost all addresses that have been holding ETH weren’t worthwhile at press time. Due to the low profitability of those addresses, the motivation for them to promote their holdings was diminished.

Together with the MVRV ratio, the long-short distinction for ETH additionally fell. A declining long-short ratio recommended that the variety of previous addresses that have been holding ETH began to say no.

Is your portfolio inexperienced? Try the Ethereum Revenue Calculator

Moreover, the state of the NFTs on Ethereum was additionally not optimistic. In response to latest knowledge, the Ethereum NFT market was at present present process a part of turbulence, marked by a major lower in each exercise and quantity.

The info revealed that transaction quantity throughout all Ethereum marketplaces has not too long ago reached its lowest level since November 2022.

Supply: Santiment