Historical Playbook Points To $3,800 In Coming Months

Famend analyst Josh Olszewicz has shared some compelling insights on Ethereum’s value trajectory. Drawing parallels from historic patterns, Olszewicz’s analysis means that Ethereum is likely to be gearing up for a major rally within the coming months.

Historic Sample: Ethereum Kinds Ascending Triangle

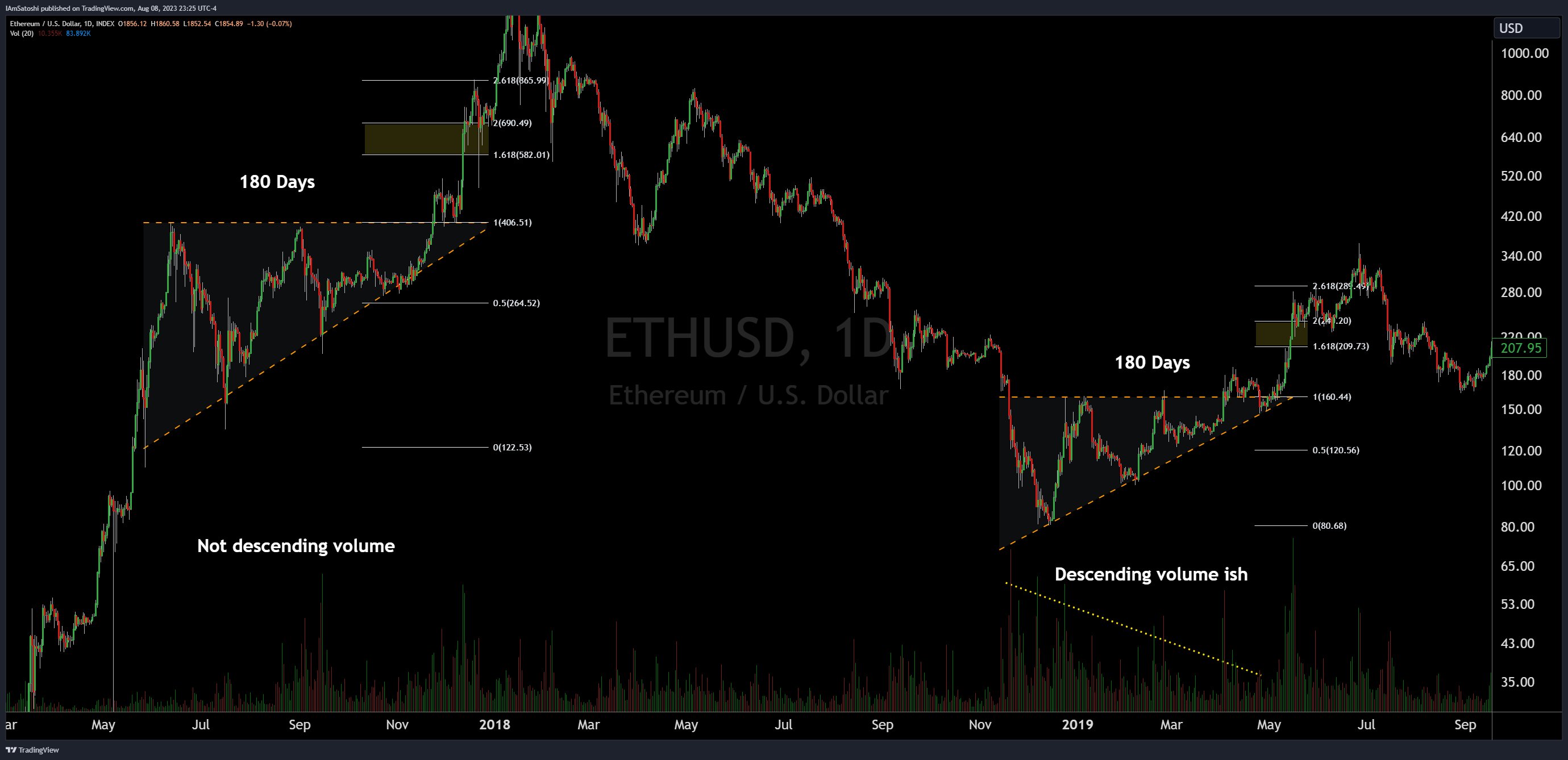

Olszewicz begins by highlighting Ethereum’s present value sample, jokingly stating, “Ethereum: ascending triangle 450 million years within the making w/fib extensions to $3k.” This ascending triangle, characterised by a flat prime and rising backside, has been forming since Could 2022, and if historical past is any information, it could possibly be a bullish signal for Ethereum.

Descending quantity, one other function of this sample, additional strengthens the bullish bias. Nevertheless, Olszewicz cautions that the “bias stays bullish till value breaks under diagonal assist.” He additionally factors out the psychological resistance at $2,000, noting it as an “extraordinarily apparent sign that it’s go time, which ought to assist the breakout.”

To bolster his evaluation, Olszewicz attracts parallels from Bitcoin’s previous. He recollects, “take BTC in 2015/2016 [the price formed an ascending triangle for 210 days with descending volume] and BTC in 2018/2019 [ascending triangle for 130 days with descending volume] as examples.” In each situations, Bitcoin surged in direction of the Fibonacci extension ranges submit the breakout.

Ethereum itself isn’t a stranger to such patterns. Olszewicz cites, “ETH has additionally had earlier examples in 2017 (bullish continuation) and 2019 (bullish reversal).” Every ascending triangle sample lasted 180 days. Each occasions ETH surged in direction of the two.618 Fibonacci extension degree.

Drawing from these historic patterns, Olszewicz means that Ethereum is at present holding the potential to overshoot the 1.618 Fibonacci degree and presumably attain the two.618 degree, which interprets to a value of $3,800. Nevertheless, he correctly advises, “however don’t get out the imaginary revenue calculator simply but, let’s break $2k first.”

ETH vs. BTC: Which One Is The Higher Commerce?

Whereas Ethereum’s potential rally is intriguing, Olszewicz additionally delves into its efficiency relative to Bitcoin. He observes that Ethereum has underperformed Bitcoin year-to-date, attributing this to the ETF narrative and Bitcoin’s dominance as onerous cash. He speculates, “the higher commerce could proceed to be BTC/USD, particularly with preliminary spot ETF inflows favoring BTC.”

Nevertheless, if the ETH/BTC pair can break and maintain new highs, it’d trace at a runaway commerce for Ethereum. However Olszewicz stays skeptical, stating it’s “unlikely primarily based on ETF flows.”

Olszewicz additionally doesn’t shrink back from discussing potential bearish situations. He’s intently watching sure bearish ETH/BTC ranges, together with the present native low at 0.050 and the earlier inverse head and shoulders neckline at 0.039.

For Bitcoin, he suggests a possible transfer to $42,000, supplied it maintains sure bullish situations. He notes, “so long as we will preserve costs above the midline of the PF & keep within the cloud, we have now a good shot at reaching $42k earlier than halving.”

Wrapping up his evaluation, Olszewicz envisions a dream commerce the place Bitcoin breaks bullish first, presumably attributable to technicals or a spot ETF approval. On this situation, Ethereum breaks $2,000 however lags behind Bitcoin, resulting in ETH/BTC getting “crushed, permitting for an eventual revenue taking rotation from Bitcoin to Ethereum”. Nevertheless, he concludes with a phrase of warning: “with out inflows, we ain’t movin.”

At press time, ETH traded at $1,860.

Featured picture from iStock, chart from TradingView.com