3 Signs That A Bitcoin Supply Shock Could Be Just Days Away

The Bitcoin group is at present abuzz with discussions of an impending provide shock, a market phenomenon the place demand outstrips provide, probably resulting in a considerable value improve. Indicators from numerous sectors inside the market are at present converging, suggesting that such an occasion could also be nearer than many anticipate. Right here’s an in-depth take a look at three indicators for an impending provide shock:

#1 Surging Demand For Bitcoin ETFs

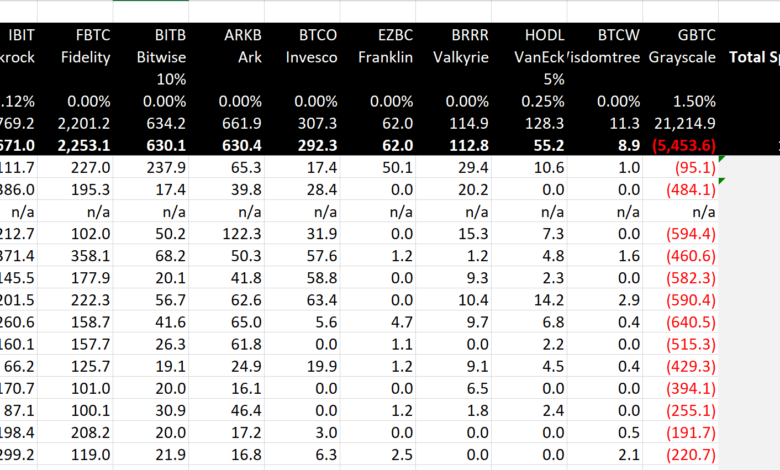

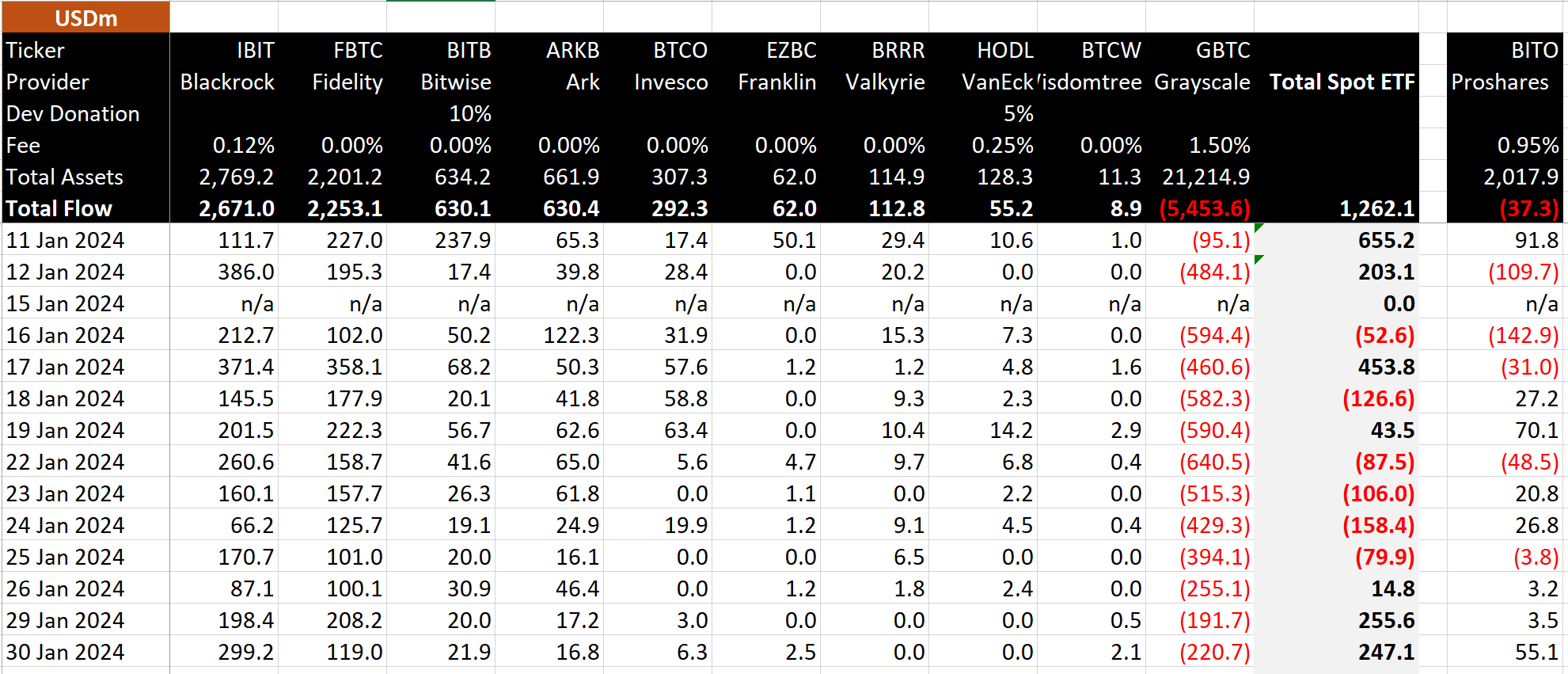

Bitcoin ETFs have been creating an exceptionally giant demand since their launch. Initially, this demand surge was considerably moderated on account of vital outflows from the Grayscale Bitcoin ETF (GBTC). Nevertheless, day 13 of the Bitcoin ETFs confirmed as soon as once more that the Grayscale outflows are slowly slowing down (yesterday: $220.7 million, beforehand $191.7 million), whereas the final two buying and selling days noticed web inflows for all ETF issuers of round $250 million.

Dan Ripoll, managing director at Swan, offered an in depth analysis on the sheer magnitude of this. “The Bitcoin spot ETFs have already snatched up 150,500 BTC in simply 13 buying and selling days. They’re shopping for at a fee of 12,000 BTC per day. Now, let’s KISS (maintain it easy silly). There are solely 900 BTC per day being issued. BTC is being purchased up at a fee of 13x day by day issuance. In 3 months, the issuance can be lower in half, driving the demand/provide imbalance to a staggering 26x day by day issuance!”

Moreover, Alessandro Ottaviani, a revered Bitcoin analyst, underscored the potential market shift, stating, “Now that the Bitcoin ETF influx will at all times be increased than the Grayscale outflow, the one solution to accommodate that demand can be by means of a rise of value. As soon as we attain $60k and much more after the brand new ATH, Institutional FOMO can be formally triggered, and will probably be one thing that the human being has by no means skilled.”

WhalePanda, a famend crypto analyst, highlighted latest actions, including credibility to the brewing provide shock: “Yesterday one other ~$250 million web influx into Bitcoin ETFs with Blackrock doing a stable $300 million all by itself. Two days of $250 million influx, the value didn’t rally a lot yesterday, however a few days like this, and also you’ll see what sort of provide shock it will have on BTC.”

#2 Large Bitcoin Miner Promoting Absorbed

Regardless of a considerable stream of cash from miner wallets to identify exchanges, the market has proven exceptional resilience. In line with a report from Cryptoquant:

“Yesterday, the stream of cash in miner wallets going to identify exchanges recorded the very best worth since Might 16, 2023. In complete, greater than 4,000 Bitcoins flowed to identify exchanges, round $173 million in promoting stress. Nevertheless, this promoting stress was calmly absorbed by the market.”

It’s important to notice that regardless of these interactions, the reserves in mining portfolios have remained constant because the starting of January, indicating that the market has successfully absorbed the promoting stress with out vital value depreciation.

#3 Stablecoins Aka “Dry Powder” On The Rise

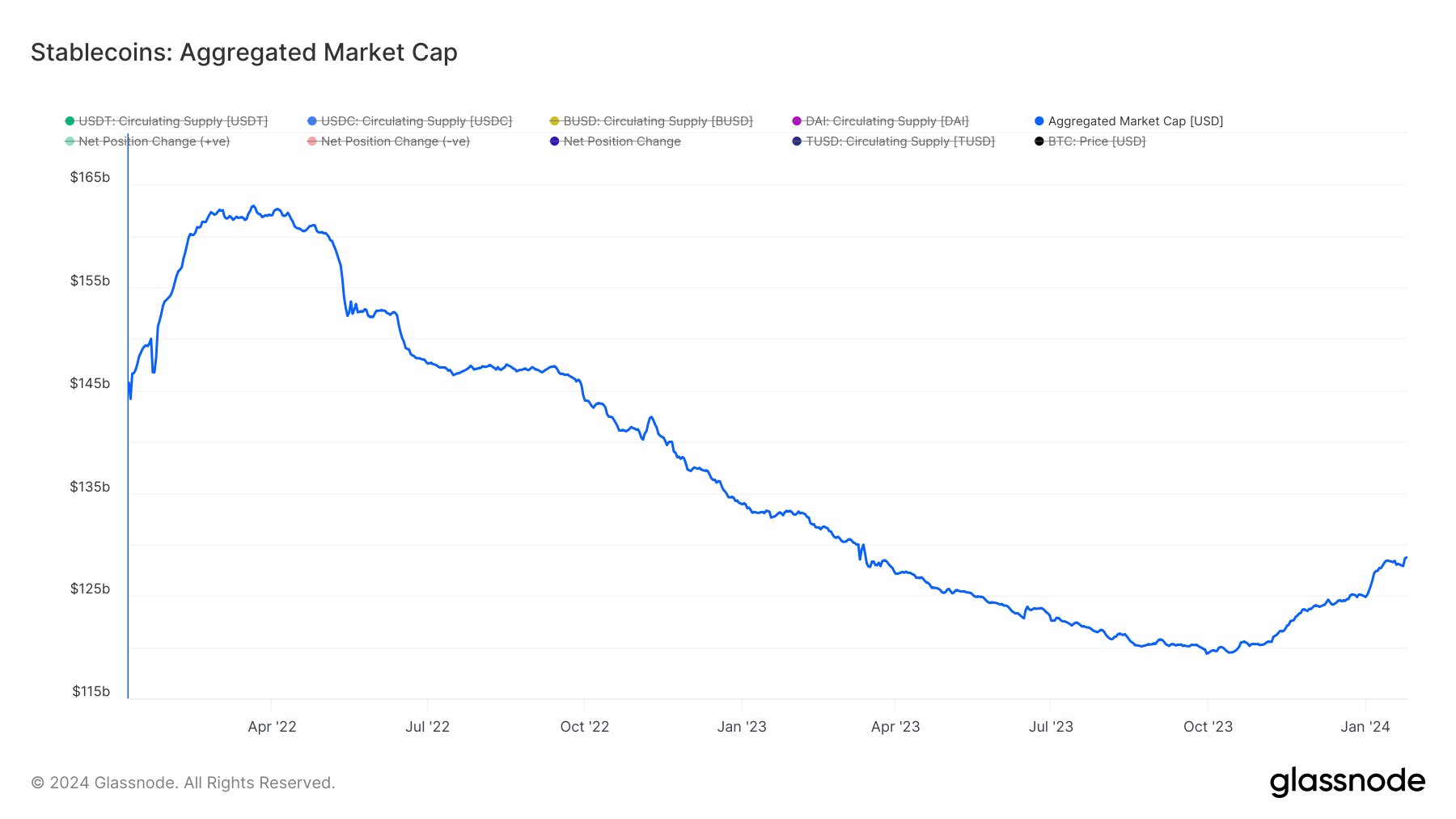

The stablecoin aggregated market cap serves as a precursor to potential market actions. Lately, the stablecoin aggregated market cap has proven a major rebound, shifting from a backside of $119.5 billion in mid-October 2023 to nearing $130 billion.

This rise in stablecoin reserves is commonly interpreted as “dry powder,” able to be deployed into property like Bitcoin, probably additional accelerating the availability/demand mechanics. Alex Svanevik, founding father of on-chain evaluation platform Nansen, remarked on the correlation between stablecoin reserves and BTC value: “When stables on exchanges peaked, BTC value peaked.”

At press time, BTC traded at $42,848.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding selections. Use info offered on this web site completely at your individual danger.