Ethereum: Sell-off prediction looms as price falls 1.5% in 7 days

- ETH was down by greater than 1.5% within the final seven days.

- If ETH initiates a bull rally, it would face resistance close to $2,300 and $2,400.

The yr 2024 started on a candy word as Ethereum’s [ETH] worth surged above $2,400. Nevertheless, the king of altcoins witnessed a value correction, pushing its worth below $2,300 as soon as once more.

Whereas this occurred, an fascinating whale exercise occured.

Ethereum’s chart turns crimson

After a snug starting in 2024, ETH fell sufferer to a value correction on the third of January. Due to the value correction, ETH’s worth plummeted by greater than 1.6% within the final seven days.

In line with CoinMarketCap, on the time of writing, Ethereum was buying and selling at $2,243.76 with a market capitalization of over $269 billion. Amidst this, Lookonchain lately posted a tweet highlighting an intriguing growth.

Evidently #Paradigm deposited 6,500 $ETH($14.67M) into #Coinbase 2 hours in the past.#Paradigm may be very sensible, accumulating $ETH in bear markets and promoting $ETH in bull markets.https://t.co/TF3lEGhJvZ pic.twitter.com/XI5LV075iH

— Lookonchain (@lookonchain) January 6, 2024

As per the tweet, Paradigm deposited 6,500 ETH on Coinbase, which was price greater than $14.6 million. If historic knowledge is to be thought of, Paradigm has all the time purchased ETH throughout bear markets and bought ETH in bull markets to earn income.

Due to this fact, since Paradigm dumped ETH, does this imply a bigger sell-off is on its approach?

Are whales promoting Ethereum?

AMBCrypto deliberate to examine Ethereum’s whale exercise to see how they have been behaving. Notably, Ali, a preferred crypto analyst, posted a tweet on the sixth of January, which revealed a promising growth.

As per the tweet, prior to now month, Ethereum whales purchased over 410,000 ETH, price almost $1 billion. This confirmed that the whales have been stockpiling ETH in hopes of a bull rally.

Up to now month, #Ethereum whales purchased over 410,000 $ETH, price almost $1 billion! pic.twitter.com/1gGguoEypx

— Ali (@ali_charts) January 6, 2024

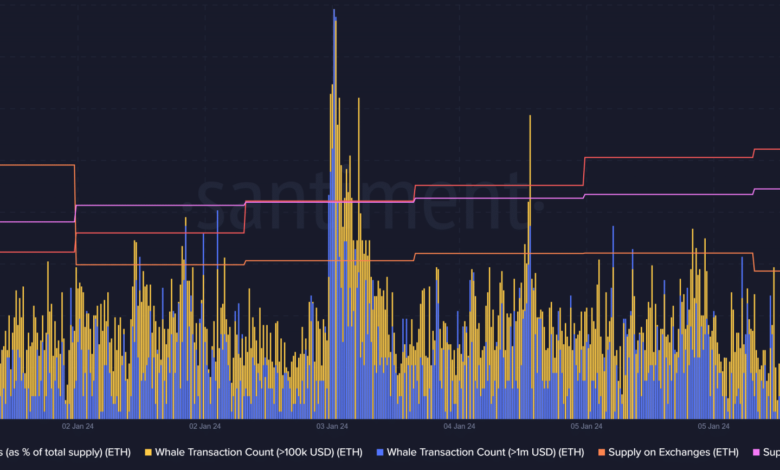

Our evaluation of Santiment’s knowledge painted an analogous image. AMBCrypto discovered that whale exercise across the token remained excessive, as evidenced by the spike in its Whale Transaction Rely.

Its provide held by prime addresses additionally elevated final week, that means that whales have been accumulating extra ETH till press time.

Supply: Santiment

Not solely the whales, however the market at giant additionally appeared to have been shopping for Ethereum. The token’s Provide on Exchanges dropped final week, whereas its Provide outdoors of Exchanges elevated.

Additionally, AMBCrypto’s evaluation of CryptoQuant’s data confirmed that ETH’s web deposit on exchanges was low in comparison with the final seven-day common, clearly reflecting excessive shopping for stress.

To prime it off, ETH’s Coinbase Premium was within the inexperienced, which meant that purchasing sentiment was dominant amongst US buyers at press time.

It was fascinating to notice that on the one hand, shopping for stress on ETH was growing, whereas however, the blockchain’s community exercise declined.

AMBCrypto had earlier reported that BNB Chain [BNB] has surpassed Ethereum by way of person exercise over the previous month. As per the information, only one.28 million lively addresses transacted on Ethereum, witnessing a 13% drop in person exercise.

Supply: CryptoQuant

Will excessive shopping for stress provoke a bull rally?

Whereas shopping for stress elevated and costs sank, ETH’s derivatives market metrics considerably turned bullish. For instance, ETH’s Open Curiosity dropped together with its value. Such situations point out an elevated probability of a pattern reversal.

Its BitMEX Funding Price additionally declined final week, and market sentiment across the token remained bearish, as proven by the dip in Ethereum’s Weighted Sentiment.

Supply: Santiment

If we think about that ETH will quickly start a bull rally, it will nonetheless have fairly a couple of limitations to beat to skyrocket its value. To seek out that, AMBCrypto took a better take a look at ETH’s liquidation heatmap.

Learn Ethereum’s [ETH] Worth Prediction 2023-24

Our evaluation discovered that if a bull run is certain to occur, ETH would face a powerful resistance stage close to the $2,300 mark. And if it goes above that stage, then ETH’s would face its subsequent barrier at $2,400.

The final time ETH’s value touched these ranges, its liquidation spiked sharply.

Supply: Hyblock Capital