Ethereum: Why an ETH explosion is just a matter of time

- The falling change reserve got here alongside rising energetic addresses.

- The metrics pointed towards confidence in Ethereum in the long term.

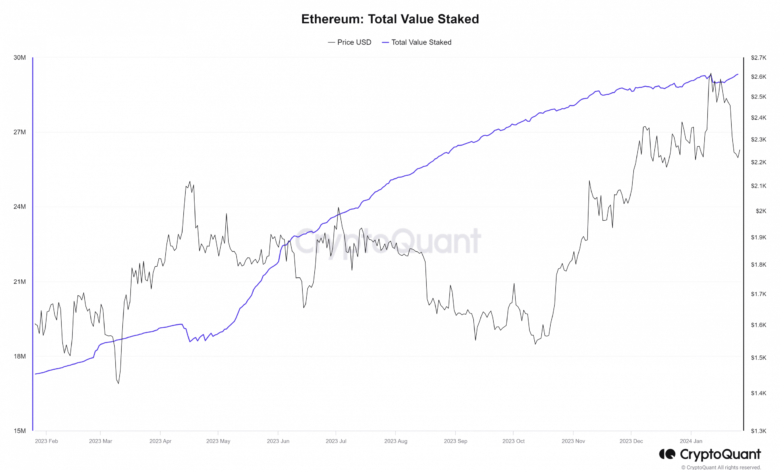

Ethereum [ETH] famous a major uptrend within the whole worth staked up to now 9 months. AMBCrypto discovered that regardless of fluctuations in costs or the upper timeframe developments within the worth motion, this metric has climbed from 19 million ETH to 29.3 million ETH at press time.

This was a major, but regular uptick.

The circulating provide of Ethereum stood at 120.18 million ETH at press time, based mostly on knowledge from CoinMarketCap. This was an indication that traders trusted ETH and the community enormously, regardless that it’s not evident on the worth chart simply but.

Ethereum remains to be underperforming Bitcoin

Whereas the full staked ETH measured 24% of the circulating provide, its uptrend has slowed since December. It rose by solely 600k ETH up to now two months, in comparison with the 1.6 million ETH it gained within the two months earlier than then.

Supply: CryptoQuant

On the similar time, the Ethereum on exchanges has declined. This downtrend has been in play since 2020. Mixed with the rise in staked ETH, the inference was a powerful confidence in ETH 2.0 out there.

Supply: CryptoQuant

Ethereum additionally has a deflationary nature. The previous yr noticed a -0.28% change within the Ethereum provide, in keeping with knowledge from YCharts. A latest report from AMBCrypto famous that the Bitcoin spot ETF approval information dented the energetic validators rely.

Supply: Glassnode

Glassnode knowledge confirmed that the metric trended downward for the reason that third of January. Nevertheless, it initiated a restoration on sixteenth of January. Earlier than this dip, the metric had been in an uptrend since 2021 when Glassnode started gathering knowledge for this metric.

The energetic addresses rely appeared to plateau

The mix of falling change reserves, rising validators, and rising ETH staked pointed towards strong community safety. The energetic addresses metric has additionally been in an uptrend since November 2023.

Supply: CryptoQuant

Nevertheless, the 7-day SMA noticed a major dip within the second half of January. This adopted the sharp drop in costs ETH suffered, falling from $2.7k to $2.2k. The previous 5 days noticed the energetic addresses rely rise as soon as once more.

Learn Ethereum’s [ETH] Value Prediction 2024-25

Total, the metrics mentioned right here all level towards a big portion of customers having a long-term bullish outlook on Ethereum, given their willingness to stake ETH.

Validators are additionally incentivized to behave positively. The community utilization was rising and will drive additional demand.