Solana Price Could Surge To $30 Upon Overcoming This Resistance

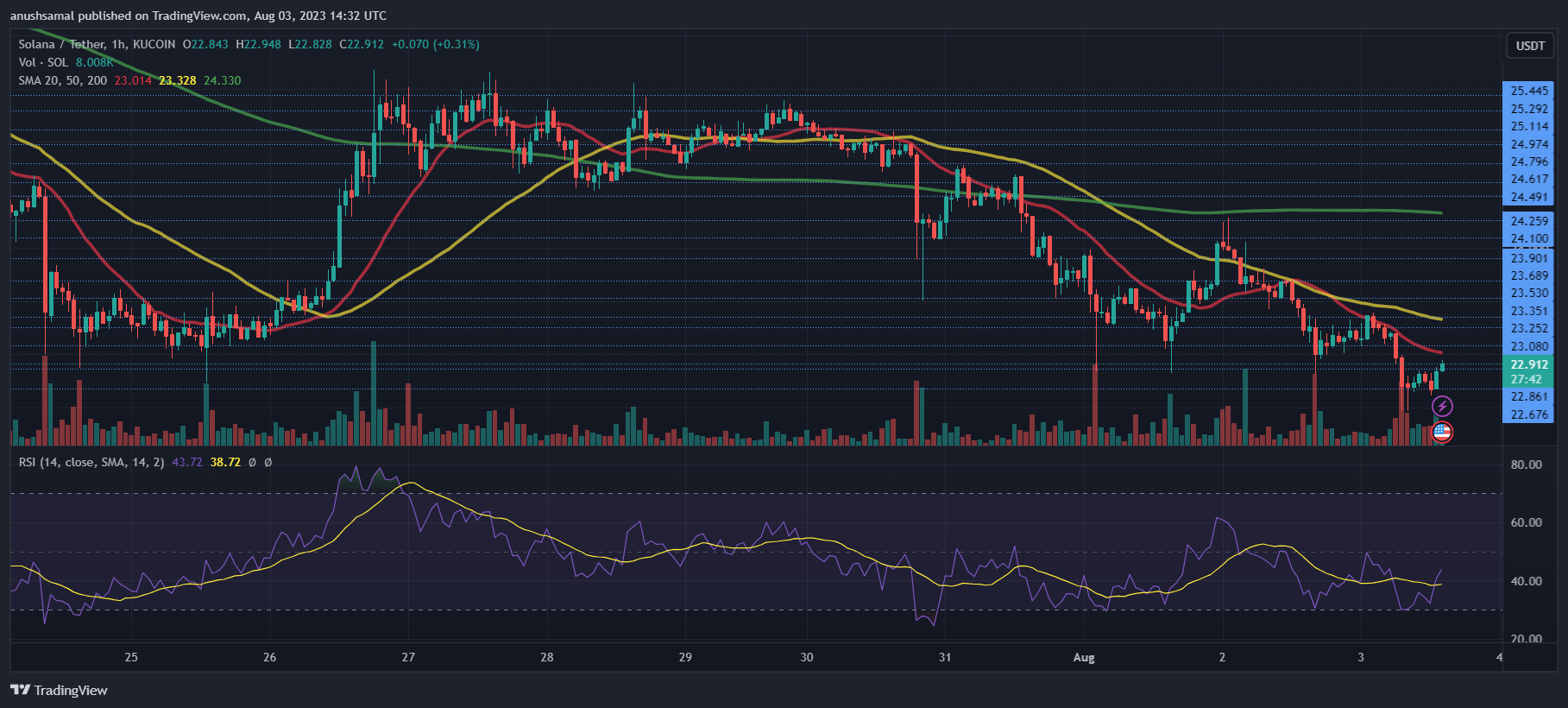

The Solana value skilled notable positive aspects in mid-June, however a latest correction section has pulled it right down to $22, which has discovered robust assist. The technical outlook at the moment leans in direction of the bears, suggesting a possible slight dip earlier than a doable turnaround.

The altcoin tried to rise from the assist degree up to now week, however the bullish momentum waned. Regardless of the prospect of a rally attributable to a requirement zone under $22, a brand new resistance on the $25 degree might pose a problem.

As Bitcoin slipped into the $29,000 vary, different altcoins additionally confronted downward stress on their charts. For SOL to reverse its development, total market energy is important. The falling market capitalization of SOL signifies continued management by sellers over the value.

Solana Value Evaluation: One-Day Chart

On the time of writing, SOL was buying and selling at $22.80, demonstrating stability round a big assist zone. Though a drop from this degree may appeal to patrons, there’s a risk that the altcoin may slip under the $20 mark. If patrons step in, the subsequent resistance ranges can be $23 and $25.

As soon as the $25 value mark is breached, Solana may purpose for $30, signifying a possible 36% rally. Nonetheless, SOL should keep away from falling under $20, as that might nullify any bullish revival. Within the final session, the quantity of SOL traded declined, suggesting a lower in shopping for energy.

Technical Evaluation

SOL confirmed elevated promoting stress, indicating patrons had not but entered the optimistic zone. The Relative Power Index remained under the half-line, stressing the dearth of bullish momentum as sellers outnumbered patrons on the time of remark.

Furthermore, SOL was positioned under the 20-Easy Shifting Common line, signifying an absence of demand at this degree and additional suggesting that sellers had management over the value momentum out there. The upcoming buying and selling classes maintain significance for the coin as patrons will decide the altcoin’s future course.

The altcoin’s low demand has led to the formation of promote indicators. This indicated the continued dominance of bears out there. Nonetheless, it’s value noting that the dimensions of those promote indicators is step by step reducing.

The Shifting Common Convergence Divergence (MACD) indicator, which measures value momentum and development adjustments, confirmed pink histograms. This studying was linked to promote indicators. Regardless of this, the promote indicators have been comparatively brief, suggesting that the altcoin may see some shopping for energy within the upcoming buying and selling classes.

Then again, the Directional Motion Index (DMI), which signifies value course, remained adverse. The -DI line (orange) was positioned above the +DI line (blue).

Conversely, the Common Shifting Index was above the 40 mark, indicating {that a} change in value course may very well be anticipated within the subsequent buying and selling classes.

Featured picture from UnSplash, charts from TradingView.com