Ethereum Dominates Corporate Blockchain Adoption With NFTs, Tokenized Assets: Galaxy Report

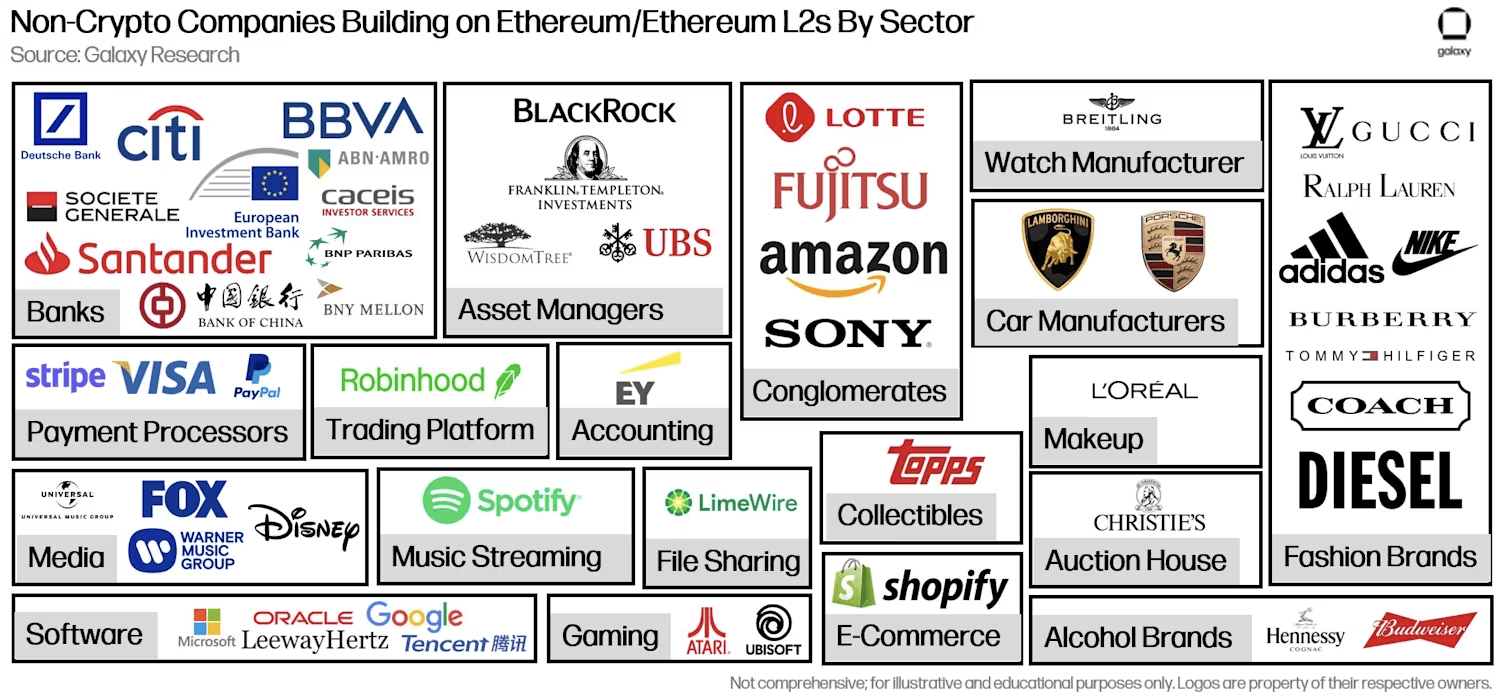

Over 50 non-crypto corporations, together with international banks and luxurious manufacturers, are constructing blockchain-based merchandise on Ethereum and its layer two networks, specializing in NFTs, tokenized belongings, and scalable infrastructure, in keeping with a Galaxy Digital report.

Conventional Finance and Retail Giants Wager on Ethereum’s L2 Networks

Greater than 50 conventional corporations, together with monetary establishments like Deutsche Financial institution and Paypal and types like Louis Vuitton and Adidas, are creating crypto-specific functions on Ethereum and its layer two (L2) networks, in keeping with a report by Galaxy Digital Vice President of Analysis Christine Kim. These efforts concentrate on non-speculative use circumstances similar to real-world asset (RWA) tokenization, NFTs, and Web3 gaming, bypassing common crypto infrastructure like exchanges.

Galaxy Digital’s analysis charts 55 conventional enterprises actively crafting blockchain-driven frameworks and decentralized instruments on Ethereum and its L2 ecosystems, signaling a pivot towards Web3 integration past speculative tendencies.

Ethereum leads in RWA tokenization, internet hosting practically 10 instances the worth of belongings in comparison with rival blockchain Stellar, per Galaxy Analysis. Of 20 monetary establishments constructing crypto infrastructure, 13 subject RWAs—together with Blackrock’s Ethereum-based fund, BUIDL. Stablecoins additionally thrive on Ethereum, with Paypal’s PYUSD and Robinhood’s USDG driving a 70% provide surge in 2024. Ethereum instructions over 50% of the $400 billion stablecoin market.

Scalable infrastructure investments underscore company adoption. Deutsche Financial institution is creating an Ethereum L2 with ZKSync for compliant finance options, whereas Sony’s Soneium rollup targets gaming and leisure. These initiatives spotlight Ethereum’s function as a basis for customizable, enterprise-grade blockchains regardless of debates over centralized management, as seen in Sony’s oversight of Soneium exercise.

Gaming drives NFT innovation, with corporations like Atari and Lamborghini launching L2-based platforms. Atari deployed basic video games on Coinbase’s Base community, providing NFT rewards, whereas Lamborghini’s Fastforworld permits cross-game digital automobile possession. South Korea’s Lotte Group companions with Arbitrum for its “Caliverse” metaverse, citing the L2’s 250ms block speeds as essential for seamless gaming.

Ethereum’s L2-centric roadmap balances scalability and safety, attracting establishments searching for environment friendly onchain options. Regulatory tailwinds, together with SEC concentrate on tokenization, and partnerships like Stripe’s $1 billion acquisition of stablecoin platform Bridge, sign rising mainstream adoption.

Galaxy’s report concludes Ethereum stays the popular chain for finance-focused crypto providers, with RWAs and stablecoins poised for growth in 2025. “Because the general-purpose blockchain with the best degree of decentralization, the widest attain for crypto-native customers, and the longest observe document for community uptime, Ethereum is the gateway that many establishments are utilizing to incubate and launch finance-focused crypto providers and merchandise,” Kim famous.