The “Vibecession” Is Over?? (Here’s What That Means)

TL;DR

-

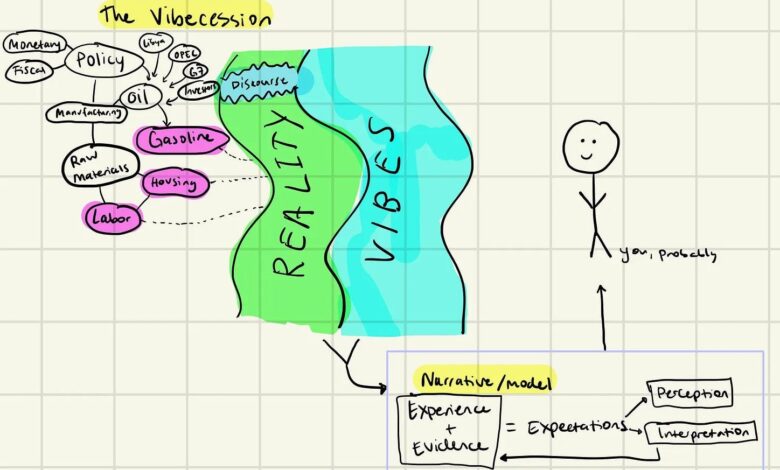

A Vibecession is principally a time frame the place the financial system is doing fantastic, however the market’s common outlook is bleak.

-

The variety of brick-and-mortar shops that settle for Bitcoin has tripled prior to now 12 months.

-

Past the west, particularly in Latin America the place the vast majority of this adoption is going down, we’re seeing considered one of Bitcoin’s core options thrive: Safety towards poor financial coverage and crippling long run inflation.

Full Story

Once we develop up, we need to be Kyla Scanlon. Why?

Trigger daily, we attempt to take complicated technical/financial ideas, and use easy, usually foolish terminology to make sense of it (to ourselves, and our readers).

And Kyla is the G.O.A.T. in terms of that course of.

Her self-coined time period “Vibecession” was even added to the dictionary. Not city dictionary – the dictionary.

A Vibecession is principally a time frame the place the financial system is doing fantastic, however the market’s common outlook is bleak.

Or as Kyla places it:

“Economically talking, issues are okay-ish however in actuality…the vibes are off.”

Once we first heard it, we instantly went “oh, that was all of 2023.”

Trigger whereas it felt like we had been amidst a grueling bear market…

-

Bitcoin greater than doubled.

-

The inventory market climbed to an all-time excessive in This fall.

-

And we skilled one of many largest financial institution failures in US historical past, with out plunging into recession.

Right now, we’ve a brand new piece of knowledge so as to add to that record, that we’re submitting beneath:

“Much less spectacular on the grand scale of issues, however a terrific indicator for crypto adoption, and one other signal that we had been positively in a vibecession in 2023.”

Which is: the variety of brick-and-mortar shops that settle for Bitcoin has tripled prior to now 12 months.

Taking a look at this by way of a western framework, you would possibly assume:

“Okay. So, Bitcoin millionaires now have someplace to spend their new discovered fortunes? That is good I assume…”

However past the west, particularly in Latin America the place the vast majority of this adoption is going down, we’re seeing considered one of Bitcoin’s core options thrive:

Safety towards poor financial coverage and crippling long run inflation.

What is the reverse of a vibecession? A interval of ‘vibenomic progress’?

No matter it’s, we’re feeling it.