Ethereum gas fees drop to five-year low: Is this good news for ETH?

- Ethereum gasoline charges has fallen under $100,000.

- The overall provide of ETH has elevated in the previous few months.

Ethereum [ETH], as soon as infamous for its considerably excessive gasoline charges, has just lately seen an enormous decline in transaction prices.

Whereas this discount in charges has made the community extra accessible and reasonably priced for customers, it has additionally sparked considerations in regards to the potential influence on ETH worth.

Ethereum gasoline charges hit five-year lows

A report from Kaiko, dated the nineteenth of August, revealed that Ethereum’s gasoline charges have plummeted to five-year lows.

This growth is pushed by elevated exercise on Layer 2 options and the influence of the Dencun improve in March 2024.

This improve notably lowered transaction charges on Layer 2 networks, contributing to the decline in general gasoline charges.

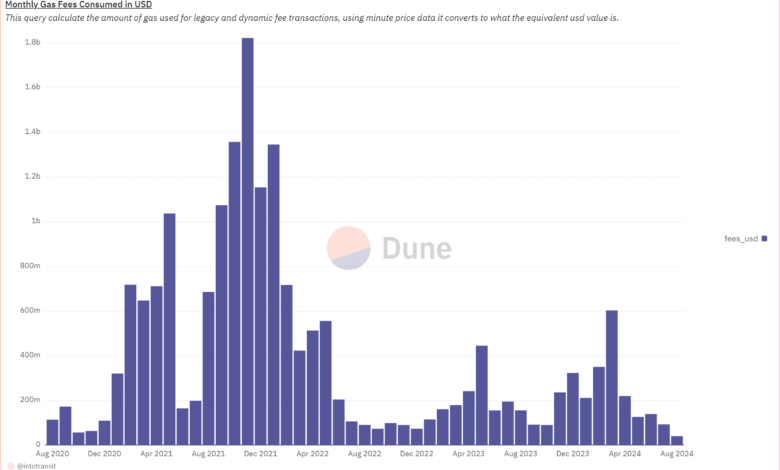

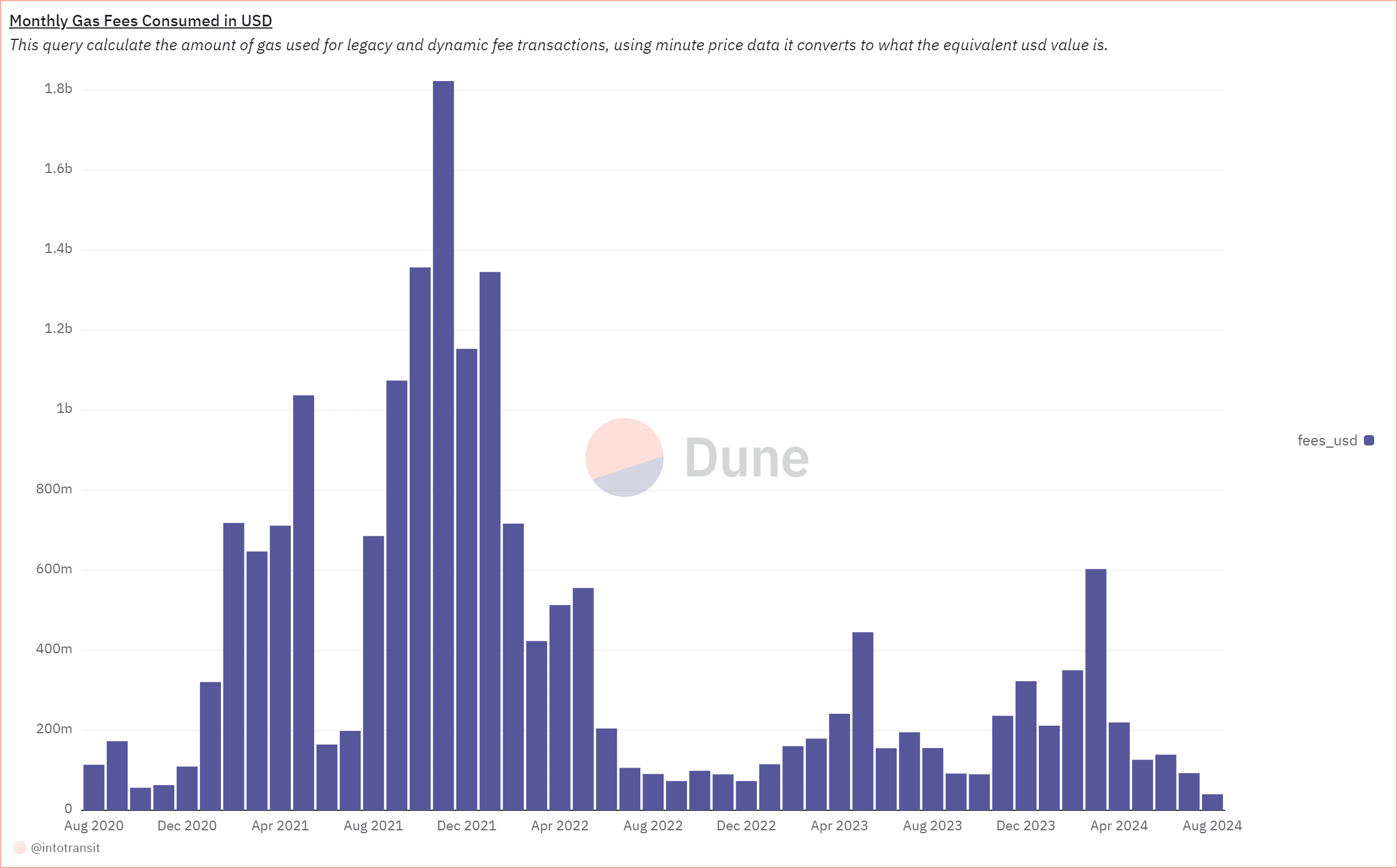

In response to Dune Analytics, March 2024 was the final time Ethereum’s gasoline charges noticed a major spike, reaching over $603.2 million.

Since then, charges have steadily declined, with July 2024 recording charges of round $93.4 million. Kaiko’s analysis means that the present month is on monitor to see the bottom charges.

Supply: DuneAnalytics

One necessary consequence of decrease gasoline charges is the discount within the quantity of ETH being burned. Beneath Ethereum’s EIP-1559 mechanism, a portion of gasoline charges is burned, successfully decreasing the provision of ETH.

With decrease charges, much less ETH is being burned, doubtlessly resulting in a rise within the token’s provide over time.

Provide enhance

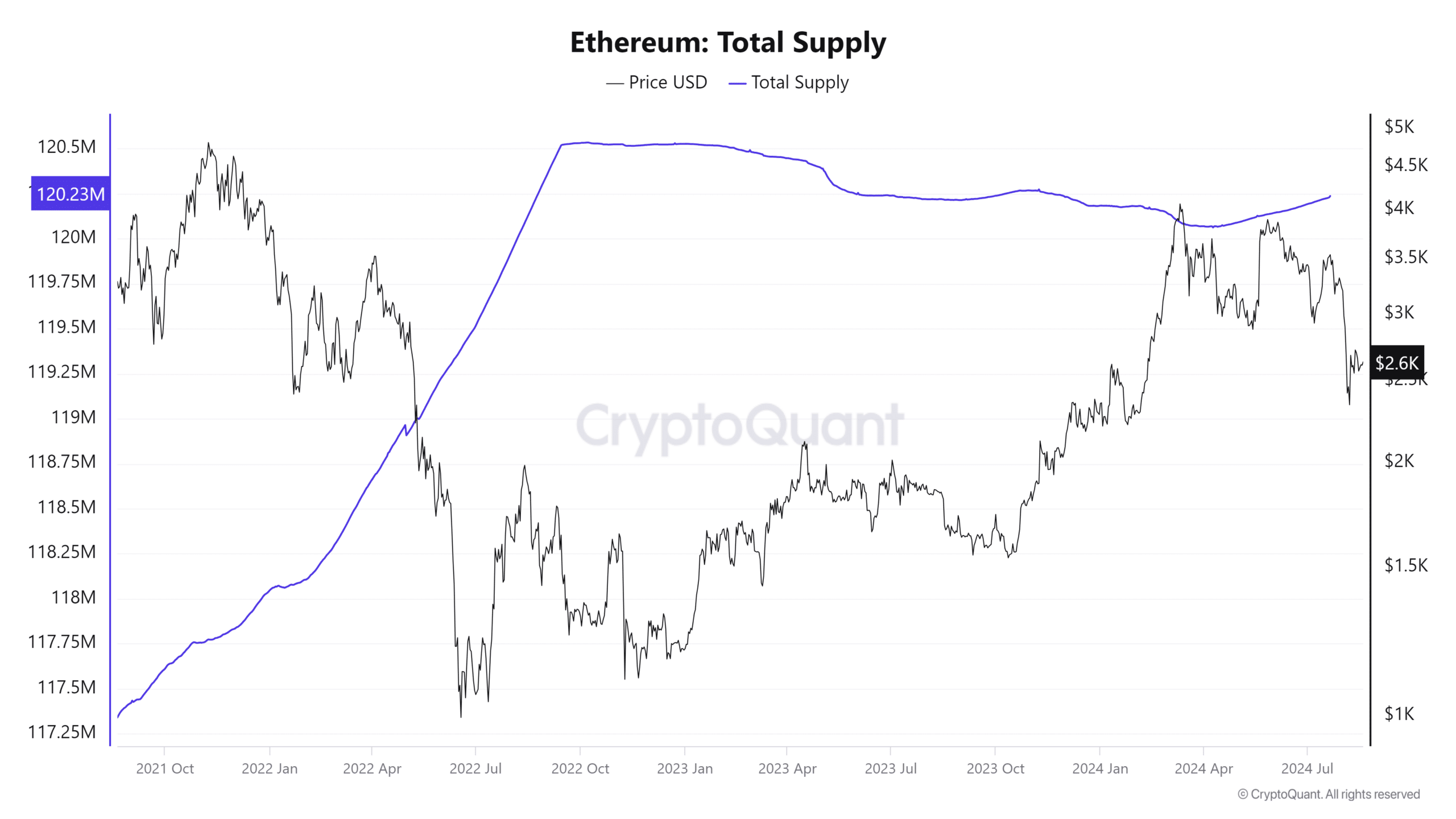

The discount in Ethereum gasoline charges, largely pushed by the Dencun improve and elevated Layer 2 exercise, has led to a lower within the quantity of ETH burned by means of transaction charges.

Consequently, the entire provide of ETH has regularly elevated from 120 million in March 2024 to over 120.2 million presently. This pattern has been gradual however constant, as evidenced by knowledge from Glassnode.

Supply: CryptoQuant

Kaiko’s report highlighted that this rising provide of ETH may mood potential value will increase within the close to time period, even within the face of optimistic demand drivers reminiscent of spot ETH ETFs.

The rise in provide, with no corresponding surge in demand, may exert downward strain on ETH costs.

ETH stays in a bear pattern

AMBCrypto’s have a look at Ethereum’s value pattern revealed that the $3,000 degree has just lately grow to be a major psychological resistance level.

As of this writing, Ethereum is buying and selling at roughly $2,648, exhibiting a slight enhance of lower than 1%.

Is your portfolio inexperienced? Take a look at the ETH Revenue Calculator

Regardless of this modest achieve, Ethereum has struggled to strategy or check the $3,000 resistance degree, with its short-moving common (yellow line) performing as a formidable barrier.

Moreover, the Relative Energy Index (RSI) for Ethereum was round 40 at press time, indicating that the market was in a robust bearish pattern.