Bitcoin: HODLing is the norm for investors

- BTC’s rising dormant provide demonstrated traders’ lack of willingness to promote.

- Traders’ sentiment was tilted in direction of the adverse aspect, in sync with the low volatility section.

Bitcoin [BTC] has entered a section of consolidation, with trades over the previous week hovering throughout the slender vary of $26,600- $27,500, based on on-chain analytics agency Glassnode. This section was just like the one witnessed through the first week of 2023, when the volatility of the king coin plunged to document low ranges.

How a lot are 1,10,100 BTCs price as we speak?

Because of the absence of volatility in both path, Bitcoin’s market witnessed considerably low on-chain quantity, reflecting a rising tendency by traders to carry their cash.

Maintain on for pricey life

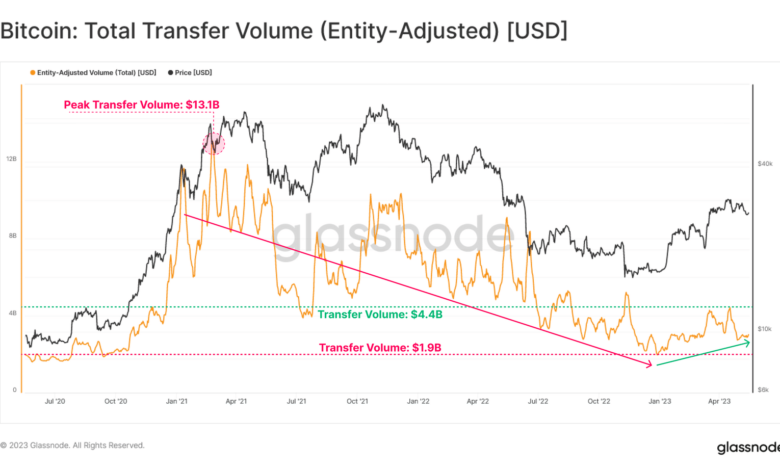

Glassnode famous a substantial decline within the switch quantity settled on the Bitcoin community. Whereas the variety of low-volume transactions involving Ordinals and BRC-20 tokens has skyrocketed, the transfers involving the motion of a giant chunk of BTC tokens have dwindled.

To additional emphasize this, there was a pointy decline within the trade deposit quantity as effectively.

Supply: Glassnode

Traders’ lack of willingness to promote was demonstrated by BTC’s rising dormant provide. The share of provide held for longer than a yr climbed to document highs. Most age bands recorded an uptick in hodling exercise.

This conduct was additionally seen in Lengthy-Time period Holder Provide, or BTC held for over 155 days, which hit a brand new all-time excessive of 14.46 million.

Curiously, the hodling narrative grew regardless of BTC accumulating huge positive aspects in 2023, practically 64% on a year-to-date (YTD) foundation.

Supply: Glassnode

Moreover, the Bitcoin Liveliness metric. which compares hodling and spending patterns, plunged to its lowest stage since December 2020. This implied that holding was the dominant narrative available in the market on the time of writing.

Is your portfolio inexperienced? Try the Bitcoin Revenue Calculator

Sluggish progress in Open Curiosity

Bitcoin continued to maneuver within the aforementioned vary on the time of writing. The coin was again above $27,000, rising 1.6% within the 24-hour interval, information from Santiment confirmed. Traders’ sentiment was tilted in direction of the adverse aspect, which was in sync with the low volatility section.

Supply: Santiment

Since mid-April, the Open Curiosity (OI) in Bitcoin futures has declined notably, reflecting an absence of hypothesis demand for the coin. This supported the notion that main individuals have been adopting a wait-and-see technique as a result of the market was not offering unambiguous purchase or promote indicators.

Supply: Coinglass