Bitcoin: Assessing the chances of a BTC trend reversal

- The Bitcoin vary formation of the previous month remained in play.

- The on-chain metrics confirmed buyers needn’t fear a few downtrend but.

Bitcoin [BTC] noticed a considerable amount of volatility on third January as costs fell by 6.3% on the day. Regardless of the promoting stress, on-chain metrics such because the Web Unrealized Revenue/Loss (NUPL) advised that the market is in a wholesome bullish state.

AMBCrypto lately reported that the Coinbase Premium was on the rise. It has been constructive since September, with a quick drop into the unfavourable territory in mid-December.

This was an indication of regular shopping for stress on Coinbase. It sparked hypothesis of constant shopping for exercise from institutional buyers forward of a Bitcoin ETF approval.

AMBCrypto took a have a look at different metrics to grasp the place BTC stands.

Assessing the accessible ammunition for the bulls

The Coinbase Premium Gap has been constructive for more often than not since October. It dipped into the unfavourable territory in mid-December. Its inference has already been talked about, however it may be mixed with different metrics to supply keener perception.

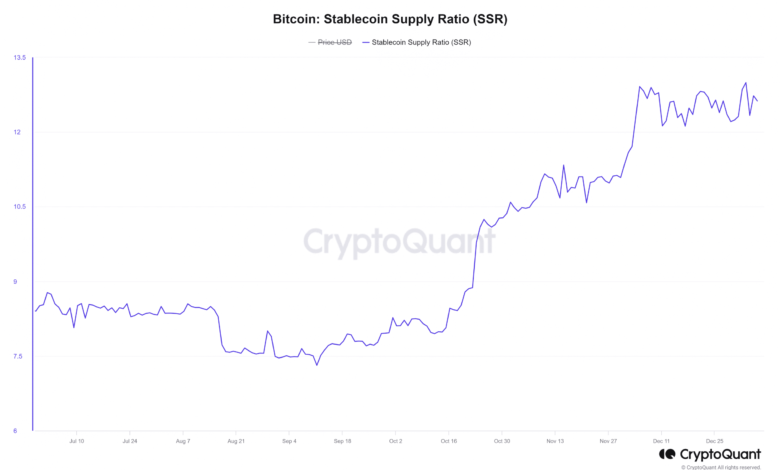

One such metric is the Stablecoin Provide Ratio. It’s outlined because the market cap of BTC divided by the entire market cap of all stablecoins. A low worth for this metric signifies excessive shopping for energy.

The chart above exhibits that the ratio has spiked since early October. This meant shopping for energy has been declining. The sturdy demand for BTC, not simply on Coinbase however throughout exchanges, noticed the king coin rally from $26k in October to achieve $44k in December.

The metric appeared to hit a ceiling over the previous month. This was an indication that market members might be watching and ready. The ETF purposes and debate over their approval and the impression on BTC costs might be inflicting this indecision.

The NUPL hit a excessive not seen since December 2021, however buyers needn’t worry

On fifth December 2023, the Bitcoin NUPL climbed above 0.5. The final time this occurred was again on twenty seventh December 2021. This doesn’t imply a reversal is across the nook. As an alternative, the market is neither in a state of euphoria nor despair.

The NUPL has shaped a plateau over the previous month. That is tied to the value motion of the asset as properly, for BTC was unable to proceed its uptrend in latest months. A rise in BTC inflows to exchanges was a part of the rationale.

The previous 5 days noticed an increase within the 7-day Easy Shifting Common of the Bitcoin Netflow. This meant that reserves on exchanges have been growing, at the same time as BTC costs straddled the vary highs. Therefore, this metric’s continued rise could be helpful to watch.

The identical uptrend occurred in mid-December as properly. This noticed Bitcoin fall from $43k to $40.5k. The vary formation of Bitcoin can be one thing buyers and merchants should regulate.

Supply: BTC/USDT on TradingView

The vary (purple) has been in play since eleventh December. It prolonged from $40.5k to $44.3k. The breakout on 2 January appeared clear, and a retest of the highs would have been a great shopping for alternative.

As an alternative, Bitcoin dropped like a rock to $40.7k on third January. Since then, it has rebounded to the $43.6k mark. The OBV has been in a gradual decline since eleventh December.

Learn Bitcoin’s [BTC] Worth Prediction 2023-24

Makes an attempt to revive an uptrend on the OBV have been lower brief. This advised a scarcity of shopping for quantity. The RSI was at 51 to sign a doable shift within the momentum in favor of the sellers.

Therefore, BTC holders should be ready for a drop to the vary lows and doubtlessly far decrease. Key ranges to observe for the approaching week are the mid-range mark at $42.5k and the latest highs at $45.9k.