Timing Bitcoin’s next cycle top as 2024 halving nears

- Projections confirmed that liquidity would attain a neighborhood peak in September 2025.

- The Bitcoin cycle is fueled by the out there liquidity.

Bitcoin [BTC] has moved inside roughly 4 cycles, with every new cycle marking a brand new all-time excessive for the costs.

From getting used to pay for pizza to having multinational funding firms market the spot BTC ETF to their prospects, the crypto neighborhood has been on some experience over the previous decade after which some.

Alongside comes a bull run each three or 4 years. And we’re on the eve of one other one, which has seemingly began. However why do we now have these cycles, and are they predictable?

The fundamental reply won’t be the entire fact

Avid crypto customers would instantly reply that the Bitcoin halving cycle is timed on a four-year clock.

The mining issue and block time are adjusted in such a means that the mining rewards are halved roughly as soon as each 4 years.

So, there you go. Every extra miner within the community sees the hash price and safety improve, however the block time retains getting adjusted.

To justify the mining prices, Bitcoin’s worth has to go up, and the halving places much more upward stress.

Nevertheless, like all the pieces, the reply has extra nuances. Bitcoin and the remainder of the crypto market symbolize an especially unstable asset class. They arrive with a considerable amount of related threat.

Fraud, safety (particular person and even change, they’re all weak to hackers), regulatory oversight, and volatility are simply a few of them.

Liquidity is a key element to understanding the four-year cycle

When the economic system is in a tough spot, securing funds for funding is harder. This implies safer belongings are in demand.

Conversely, when liquidity is plentiful, the general public is extra open to dipping their toes into riskier asset lessons, with crypto being considered one of them.

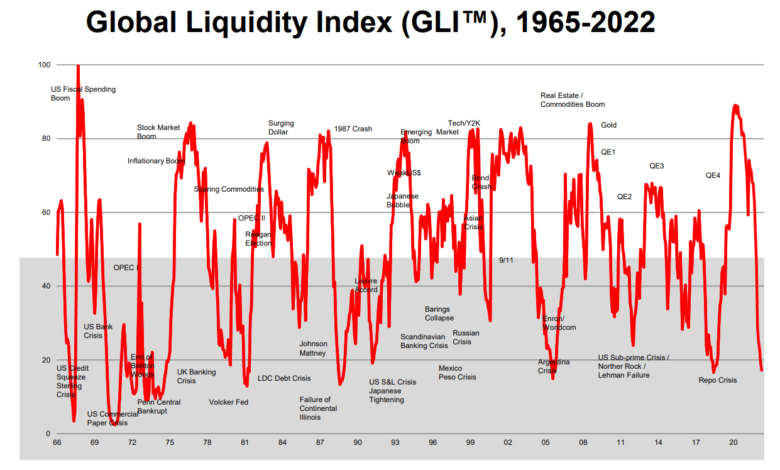

Supply: CrossBorder Capital

The World Liquidity Index (GLI) chart ranges from 0-100 and captures the World Liquidity Cycle as a normalized index.

The COVID-19 pandemic pressured the financial coverage towards reducing the price of debt and quantitative easing.

This sparked an increase in inflation that the US Federal Reserve, for instance, has been combating over the previous two years by elevating rates of interest. As of 2024, their stance is that the charges will seemingly not be hiked once more.

Supply: CrossBorder Capital

A 65-month sine wave (repeating cycle) was a tough approximation of every cycle. Whereas it isn’t excellent, it doesn’t have to be.

It permits us to extrapolate and have an concept of when the following cycle’s peak or low may arrive.

Is Bitcoin’s cycle prime close to?

The information confirmed that the following cycle’s prime can be in This fall 2025, round September. This tied in effectively with a earlier, enjoyable experiment that AMBCrypto tried utilizing the Bitcoin Rainbow Chart.

We additionally discovered that Bitcoin took shut to a few years to go from December 2018 lows at $3.1k to the November 2021 excessive of $69k.

Bitcoin took 1435 days to go from the 2017 cycle excessive to the 2021 excessive. This interprets to 47.17 months, which is wanting the 65-month cycle of the index.

Nevertheless, the newest GLI excessive and low in 2021 and 2023 considerably line up with the MVRV ratio of Bitcoin.

Supply: CryptoQuant

At press time, the MVRV ratio has been in a year-long uptrend. It was nowhere near the cycle prime worth of three.7, that means that BTC costs seemingly have extra room to develop.

So, the date of September 2025 won’t line up with a Bitcoin prime, both.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

The inflow of institutional buyers has ramped up demand for BTC in the long term, however has it additionally lengthened the roughly three years that BTC took within the earlier cycle to go from backside to prime?

Solely with time will we all know the particular reply.