90% of Bitcoin holders are in profit – Should you buy more or sell?

- Promote stress on Bitcoin has elevated not too long ago.

- Market indicators regarded bearish and steered an extra worth drop.

Expectations from Bitcoin [BTC] elevated within the latest previous because the king of cryptos climbed above the $46,000 mark. Simply earlier than the transfer north, giant holders rightly recognized the shopping for alternative and stockpiled BTC.

Amidst all this, one among BTC’s key metrics reached a essential degree, which could have an effect on its worth.

Buyers purchased the dip!

Over the previous couple of days, BTC bulls stepped up their recreation because the king of crypto’s worth surpassed $46,000.

In line with CoinMarketCap, BTC was up by greater than 2% within the final seven days. On the time of writing, BTC was buying and selling slightly below $46,000 at $45,980 with a market capitalization of over $901 billion.

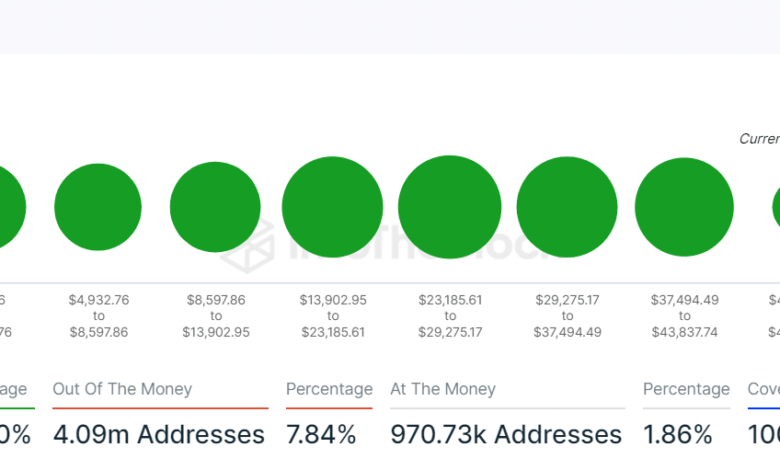

Because of the value uptick, most BTC traders had been having fun with income. AMBCrypto’s have a look at IntoTheBlock’s knowledge revealed that 90% of BTC holders had been in revenue.

Supply: IntoTheBlock

Earlier than BTC’s worth gained bullish momentum, traders tapped the chance to build up extra BTC.

As per the most recent tweet from IntoTheBlock, Bitcoin holders with >1% of the provision gathered over 14 thousand BTC up to now week. They gathered these cash when costs fell beneath the $43,000 mark.

Giant holders purchased the dip! Bitcoin holders holding >1% of the provision gathered greater than 14k $BTC over the previous week as costs dipped beneath $43k. pic.twitter.com/VgBXvtaI1o

— IntoTheBlock (@intotheblock) January 9, 2024

To verify whether or not the shopping for stress was nonetheless excessive, AMBCrypto had a have a look at knowledge from Santiment and CryptoQuant. Our evaluation revealed that BTC’s alternate reserve was growing. This clearly meant that traders had been promoting BTC.

The truth is, the space between BTC’s provide on exchanges and provide exterior of exchanges on chart was declining. This additional steered that promote stress on Bitcoin was rising.

Supply: Santiment

Bitcoin to start one other bull run quickly?

Whereas this occurred, one among BTC’s key metrics reached a essential level. Blockchain Backer not too long ago posted a tweet highlighting BTC’s Fibonacci Retracement Degree.

For initiators, the metric shows horizontal traces that point out the place help and resistance are prone to happen.

Bitcoin Market Cap hits 0.618 Fibonacci Retracement degree as BTC ETF resolution nears.

We mentioned for 2 years we might get right here. 1000’s screamed it’d by no means occur.

Now, they FOMO in. pic.twitter.com/H5ZHknZHHb

— Blockchain Backer (@BCBacker) January 8, 2024

As per the tweet, the Bitcoin market cap hit the 0.618 Fibonacci retracement degree. When the metric reached that degree in 2021, BTC’s worth reached an all-time excessive over the next weeks. Nevertheless, this time issues regarded slightly completely different as BTC’s day by day chart turned pink.

The rationale behind this sudden downtrend may very well be attributed to the FUD round ETFs as reported beforehand.

Subsequently, to see whether or not the potential of BTC beginning a bull rally was doubtless, AMBCrypto took a have a look at BTC’s day by day chart.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Our evaluation discovered a couple of bearish indicators. For instance, Bitcoin’s worth touched the higher restrict of the Bollinger Bands.

Moreover, its Cash Move Index (MFI) additionally registered a slight downtick, growing the probabilities of a continued worth drop within the coming days.

Supply: TradingView