AAVE, UNI, CRV surge amid market complexities

- Sticking to PoW helped UNI, AAVE, and CRV get pleasure from a interval of institutional adoption.

- Costs of the tokens went excessive; the identical because the TVL.

The costs of Uniswap [UNI], Aave [AAVE], and Curve Finance [CRV] elevated considerably within the final 24 hours. In response to CoinGecko, AAVE’s worth elevated by cryptocurrency 27.2%. UNI rose by 10.9% whereas CRV surged by 8.7%.

How a lot are 1,10,100 AAVEs value at present?

The spike in value could possibly be linked to the advanced interaction of things out there. A few of these embody institutional look and regulatory actions. Lately, the U.S. SEC named a number of tokens as unregistered securities.

Escape drives achieve

Most of those labeled property fall below the Proof-of-Stake (PoS) consensus mechanism. Additionally, the regulator thought-about them comparatively centralized. Consequently, institutional adoption, which has been rising since Bitcoin [BTC] ETFs approval, additionally regarded to the DeFi sector.

So, since these tokens had not but migrated to PoS regardless of being linked to Ethereum [ETH], institutional funds trooped in.

For AAVE, Lookonchain reported {that a} sure whale purported to be an establishment, gathered $13.2 million on 25 June. This motion was instrumental in sending the value up the charts.

This shift in investor sentiment highlights the rising urge for food for Decentralized Finance (DeFi) initiatives amid unclear regulation from the SEC.

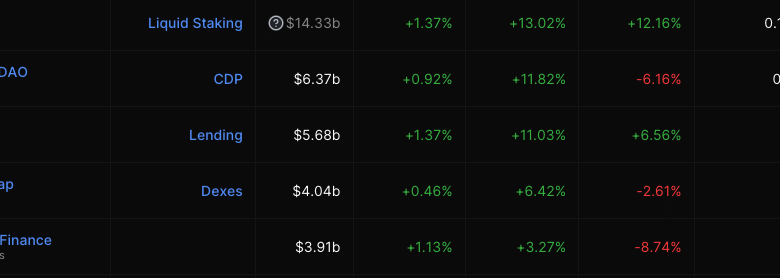

Relating to their respective Complete Worth Locked (TVL), DefiLlama showed that Aave, Uniswap, and Curve aligned in descending order.

At press time, AAVE’s TVL was $5.68 billion — an 11.03% within the final seven days. Curve’s TVL was $3.91 billion whereas Uniswap’s was $4.04 billion.

The hike within the TVL means that traders’ belief within the mission had improved. And virtually, deposits into sensible contracts working below every protocol elevated.

Supply: DefiLlama

Rising volumes for all

AAVE’s volume, which has been in an unimpressive state for some time, surged to 431.61 million. UNI additionally elevated to 135.49 million, and CRV’s quantity rose mildly to 57.73 million.

The rising quantity indicated that transactions with the token elevated. Additionally, it signifies elevated enthusiasm amongst consumers.

If this continues with out obtrusive promote strain, then the costs of the token would possibly get extra power behind them. Consequently, this might result in one other value improve.

Supply: Santiment

Life like or not, right here’s CRV’s market cap in UNI’s phrases

As outstanding DeFi tokens, AAVE, UNI, and CRV, it’s uncommon to be usually related to conventional monetary techniques.

Moreover, their respective capability to supply decentralized lending, borrowing, and yield farming has made them achieve consideration. These actions, which occur with out counting on conventional intermediaries, might have additionally performed a job in growing funding curiosity.