Ethereum to $4K now? THIS shows that sellers are backing off

- ETH’s Taker Purchase Promote Ratio rallied towards 1.

- This recommended a decline in promoting stress in its Futures market.

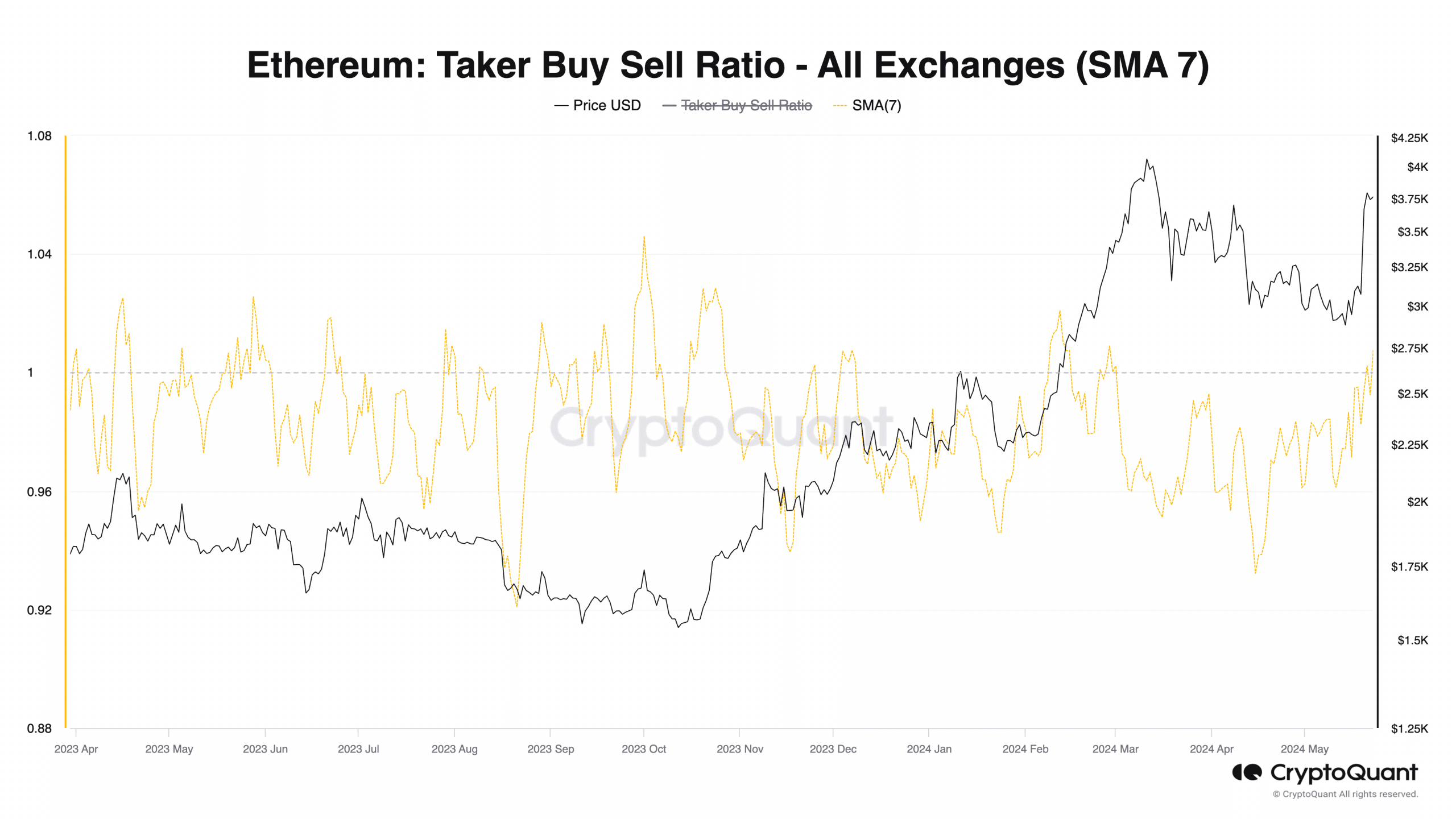

Ethereum’s [ETH] Taker Purchase Promote Ratio, noticed utilizing a 7-day easy shifting common (SMA), was poised to cross above its 1-center line at press time, in accordance with CryptoQuant’s knowledge.

This recommended a decline in promote orders within the coin’s perpetual Futures market.

Supply: CryptoQuant

ETH’s Taker Purchase Promote Ratio measures the ratio between the coin’s purchase and promote volumes in its Futures market.

When the metric rallies in the direction of 1 or returns a price higher than 1, it indicators extra purchase quantity available in the market than promote quantity. Conversely, a price under 1 signifies extra promote quantity than purchase quantity.

As of this writing, ETH’s taker buy-sell ratio was 0.99, having climbed 3% for the reason that starting of the month.

Previous to this, this metric had been in decline. In a current report, pseudonymous CryptoQuant analyst ShayanBTC famous that ETH’s Taker Purchase Promote Ratio –

“Has constantly been under 1 for the previous few months, suggesting that sellers have been extra lively within the ETH futures market.”

Based on the analyst, the ratio modified its course when the current rally started and has since climbed with ETH’s worth.

“This upward pattern within the Taker Purchase Promote Ratio signifies a possible shift in market dynamics. If the ratio continues to rise, it might sign a discount in aggressive promoting stress.”

ETH is in good palms

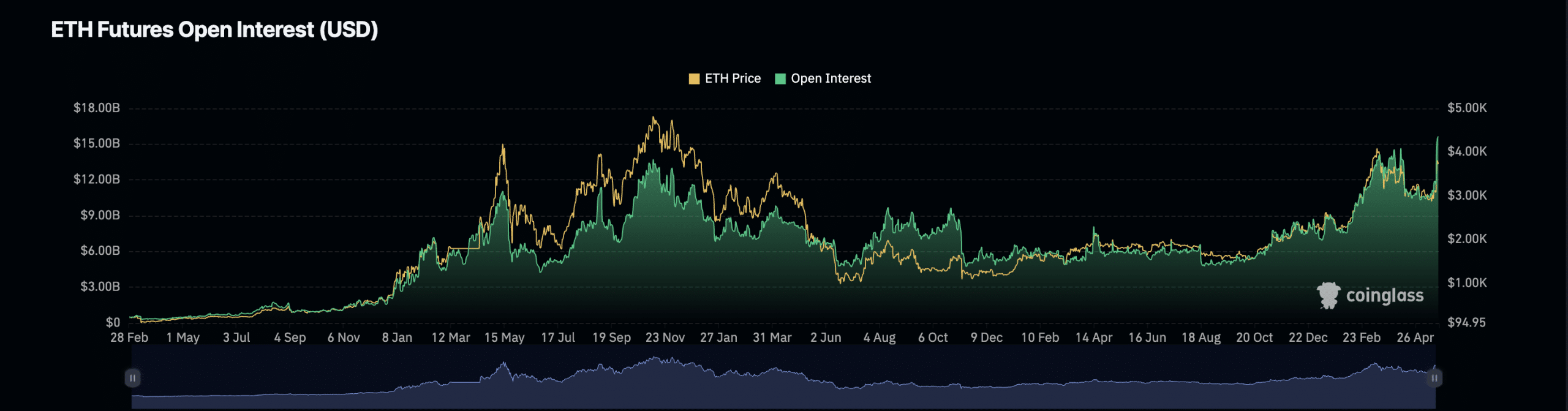

A better take a look at ETH’s Futures market confirmed the potential for a continued worth rally. Based on Coinglass’ data, the coin’s Futures Open Curiosity has rallied to a brand new all-time excessive of $16 billion.

Supply: Coinglass

Futures Open Curiosity tracks the full variety of excellent Futures contracts or positions that haven’t been closed or settled.

When it rises like this, it means that extra market members are opening new positions.

Is your portfolio inexperienced? Take a look at the ETH Revenue Calculator

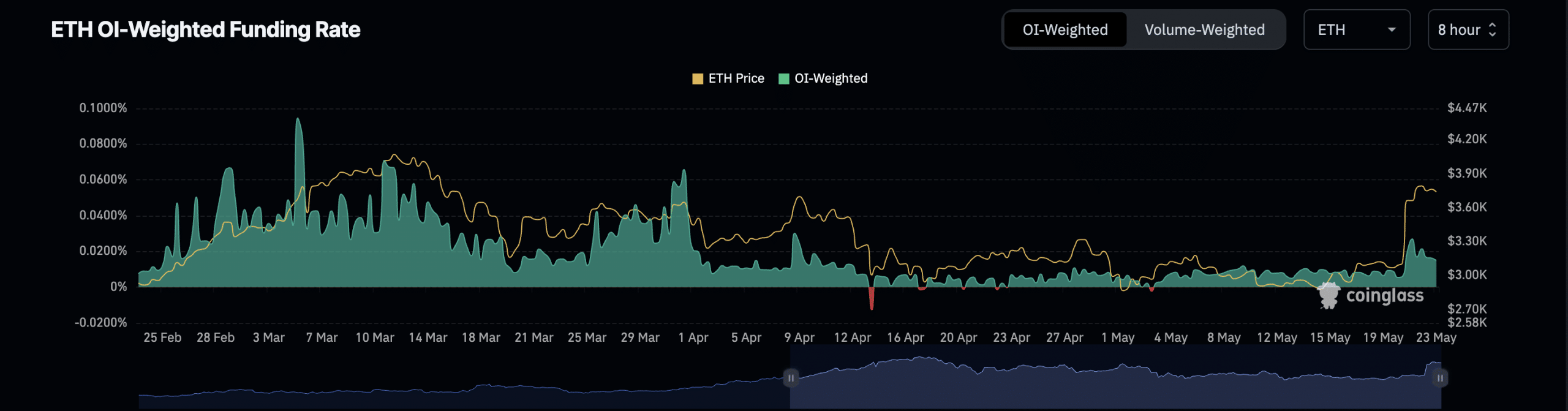

Additional, the coin’s Funding Charge has remained constructive. That is utilized in perpetual futures contracts to make sure the contract worth stays near the spot worth.

Supply: Coinglass

When ETH’s Futures Funding Charges return a constructive worth, it means there’s a sturdy demand for lengthy positions. It is a bullish sign and an indicator that the altcoin’s worth will proceed to develop.