Bitcoin’s reversion poses a great risk to BTC: Analyst

- If Bitcoin continues to correlate with equities, then the worth could plunge.

- HODLers have caught to accumulating no matter the circumstances.

Bloomberg’s senior strategist Mike McGlone has defined {that a} worth reversion for Bitcoin [BTC] might end in an incredible danger for the coin. Speaking concerning the king coin on Twitter, McGlone in contrast the Bitcoin worth at $26,000 to its correlation with shares and equities.

Learn Bitcoin’s [BTC] Worth Prediction 2023-2024

In keeping with the analyst, Bitcoin’s correlation with conventional belongings was 0.40— the very best degree it had reached because the invention of the digital asset.

Moreover, McGlone in contrast BTC’s efficiency to the season Amazon.com reached its peak, saying {that a} large lower in worth might result in one other lengthy interval earlier than BTC surpasses its ATH.

‘It Went Up, So Will Preserve Going Up’ Dangers in Bitcoin –

The teachings of high-performing, extensively hyped belongings present worth reversion often is the better danger as soon as the plenty bounce on board. #Bitcoin at about $26,000 on Aug. 28 is barely under the tip of 2020, just like… pic.twitter.com/3UdAbpLNLe— Mike McGlone (@mikemcglone11) August 28, 2023

One motive the analyst maintained the stance was the Bitcoin futures EFT approval. For McGlones, the ETF approval contributed to the drop in volatility. He additionally referred to 2021, saying that,

“The appearance of futures-based Alternate Traded Funds in 2021 helped squash volatility and augmented cash-and-carry arbitrage.”

Recall that companies like BlackRock received the SEC’s nod for a Bitcoin ETF. Nevertheless, the coin’s worth motion since then has been underwhelming on the expense of a powerful first quarter. No matter the circumstance, many consider {that a} spot ETF approval would change the tides for the higher for BTC.

Nevertheless, the SEC has delayed on this side, pushing the functions of ARK Make investments and 21Shares to undisclosed affirmation dates. However how has the affected BTC?

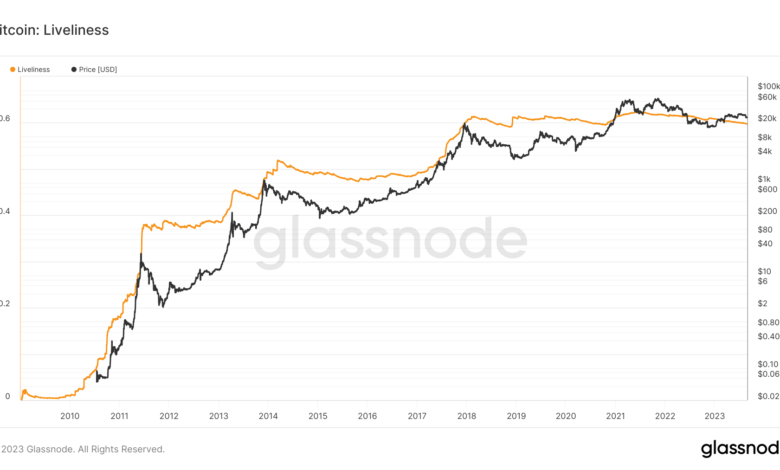

In keeping with Glassnode, Bitcoin’s present situation has not deterred traders from holding onto the coin, as indicated by its liveliness. Bitcoin’s liveliness is outlined because the ratio of the Coin Days Destroyed (CDD) to the Coin Days Created (CDC).

When the liveliness will increase, it signifies that HODLers are letting go of their cash. Nevertheless, a lower within the metric, prefer it was at press time, suggests elevated accumulation and a want to proceed holding.

Supply: Glassnode

Moreover, the Lengthy-Time period Holder (LTH) Provide had elevated to 14.53 million. The LTH supply is the whole quantity of circulating provide held by long-term holders.

How a lot are 1,10,100 BTCs value at present?

The metric makes use of a logistic perform centered at an age of 155 days and a transition width of 10 days with respect to the typical buying information to weigh the sentiment round BTC.

Subsequently, the rise within the metric prompt that traders could also be conscious of the draw back dangers. Nevertheless, the identical group of holders contemplate Bitcoin an asset value ready for the returns.

Supply: Glassnode